Vietnam Fabric Import Regulations

The industry of fabrics and garments is growing rapidly, and with this comes the many regulations for companies to import and export into Vietnam. Companies should be aware of such import duties when it comes to business within Vietnam; this will help avoid any error or disruption to their supply chain and result in more seamless and efficient import and export procedures.

Import Duties- Standards and Procedures

The Ministry of Industry and Trade, or MOIT, limits the contents of certain dyes and chemicals, such as formaldehyde, in textile products. Under this regulation, any products containing such dye or chemical in Vietnam which are either imported, manufactured, or sold will be subject to the following limitations.

Limit on formaldehyde content:

Products without direct skin contact: 300mg/kg

Products in direct skin contact: 75mg/kg

Products for children aged under three years: 30mg/kg

As of January 1st, 2019, all textile products must follow the National Technical Regulation regarding such chemical contents and, at the point of sale, must supply regulation conformity to indicate compliance by either self-declaration or authorized organization.

Import Duties- Labeling

Regulations such as Decree 89/2006/ND-CP help provide the requirements for labeling goods for sale in Vietnam. According to the stated law, product labels must include information such as the name of goods, name of organization, and origin of goods.

In turn, garment, textile, leather, and footwear products must include composition, technical specification, hygiene, safety, and use instructions. To add to this, the labels of domestically circulated items must be written in Vietnamese.

Import Tariffs

Import tariffs are typically assessed based on the cost, insurance, and freight value of the goods; this means that while most products have a similar tariff rate, it can also vary from time to time when importing particular materials with many sub-related textiles. Some textile products that may differ in import tax are as follows:

Yarn

Silk (5-10%)

Wool (0-5%)

Cotton (5%)

Man made fiber (0-5%)

Woven Fabrics

Silk (12%)

Wool (12%)

Cotton (12%)

Man made fiber (12%)

Industrial Fabrics

Apparel (5-20%)

Home furnishings (0-20%)

Carpet (12%)

Footwear (0-30%)

Travel goods (25%)

>> 5 employee qualities to help you prosper in the logistics industry

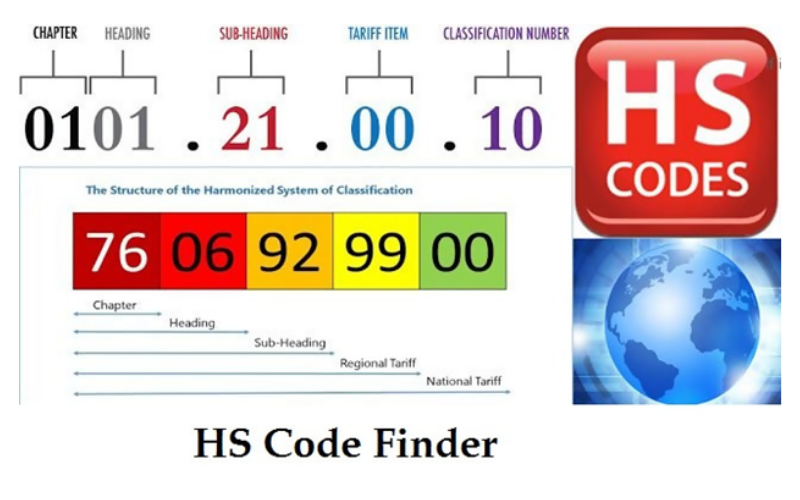

HS Code

HS Codes are designed to help identify individual products. Amongst other things, when dealing with fabrics, HS codes can range from 50 to 60 and rely on the composition of items at the time of import to assign specific codes.

The legal foundation of assigning an HS code to an item depends on the Customs Department of Commodity Verification inspection outcome. It is then passed to importers, who are eventually in charge of correct categorization.

Afraid of missing important documents? Let us help! VICO Logistics provides one-stop-shop services to help lift the weight off your shoulders! Contact us via the Messenger button at the bottom or send a quotation request to get started!

To conclude, import regulations are essential for the many possible errors that could happen if they were not in place. Companies need to be aware of such rules when importing textiles into Vietnam and international imports.

The industry's rapid growth will only call for updated regulations, and that's why it is also essential for supply chain managers to keep on top of updates in the field to help keep their company aligned with success.

----------------------

VICO LOGISTICS – Indochina Logistics Expert

Premium member of Eurocham, JCtrans, Ziegler One, VLA, VCCI,... associations

Owned offices: Hong Kong (headquarter), China (Shenzhen, Shanghai), Vietnam (Ho Chi Minh, Da Nang, Hai Phong).

Follow us for more valuable information Youtube - Linkedin - Fanpage

Book now: https://vico.com.hk/#quotation