Are you a Vietnamese business with a need to import goods into Vietnam? Are you researching information about documents and procedures to plan the production and export of goods? Do you want to avoid risks and difficulties when importing goods for the first time? In this article, VICO will help you understand the process of importing goods into Vietnam.

1. Overview of importing goods into Vietnam

Importing goods is an important business activity that requires businesses to understand legal regulations, customs requirements, and other relevant parties.

If the importation process is not handled correctly, businesses may encounter issues such as importing prohibited goods in Vietnam, leading to penalties, time loss, and costs to resolve administrative procedures. This can result in delays in the delivery of goods or not enjoying customs duty benefits.

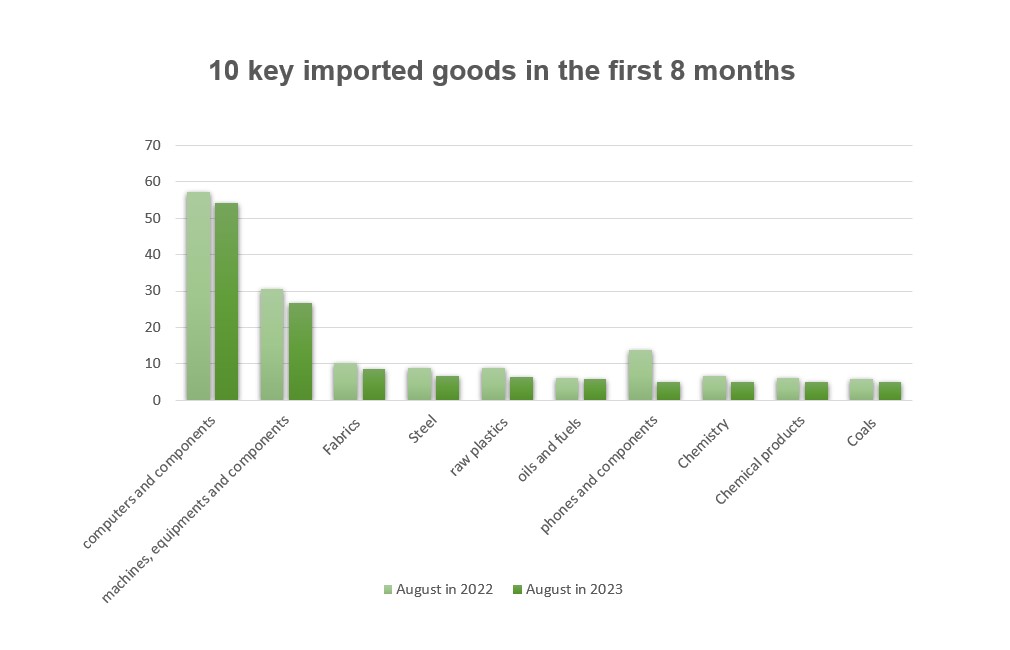

2. The ten main import commodity groups in Vietnam in the first eight months of 2023

According to data from the General Department of Customs, in August 2023, Vietnam's import and export turnover increased 8.8% to $62.08 billion compared to the previous month. Exports increased by 9% to $32.76 billion, and imports increased by 8.6% to $29.32 billion.

In terms of imported goods, in August 2023, Vietnam's imports reached $29.32 billion, up 8.6% from the previous month and 27.9% from the lowest month. The group of computers, electronic products, and components saw the most substantial increase, accounting for 50% of the country's total import growth.

The ten main groups of imported goods in Vietnam in the first eight months of the year include:

- Machinery, equipment, tools, and spare parts

- Computers, electronic products, and components

- Machinery, equipment, tools, and spare parts

- Various types of fabric

- Different types of iron and steel

- Raw plastic materials

- Various types of petroleum

- Phones of all kinds and components

- Chemicals

- Chemical products

However, by the end of August 2023, Vietnam's imports of goods still decreased by 15.9% compared to the same period last year, reaching $208.27 billion. Among the main import-export commodity groups in Vietnam, phones and components experienced the most significant decrease compared to the previous year, with the export value of this group decreasing by nearly $9 billion.

In addition to the group of phones and components, other groups also experienced significant declines compared to the same period last year, such as machinery, equipment, tools, spare parts, computers, electronic products, components, raw plastic materials, etc. With these four groups, the export-import value decreased by more than $18 billion in the first eight months of 2022. Thus, these groups contributed to about 44% of the country's overall decrease in export-import value compared to last year.

3. Process and procedures for importing goods into Vietnam

In importing goods into Vietnam, businesses need to understand the basic steps outlined below and the situations to be aware of in customs declaration.

Step 1: Import preparation (Classify goods according to import regulations)

Importers need to know the category of their goods to carry out import procedures wholly and accurately. Not all types of goods can be imported into Vietnam, and not all types follow the same import procedure.

Therefore, importers need to carefully check whether their goods fall into one of the following cases:

- Goods prohibited from import

- Interests requiring specialized inspection permits

- Interests requiring import licenses under certain conditions

In addition, businesses need to prepare the necessary documents for customs procedures. Primary documents include Commercial Invoice, Bill of Lading, Certificate of Origin, Certificate of Quality, etc. Depending on the type of goods, additional documents may be required.

Step 2: Classify goods and determine the origin

An essential step in importing goods is to classify them according to HS codes to determine the applicable customs duties. HS code is an international code system regulated by the World Customs Organization (WCO) for classifying goods according to various criteria. The HS code consists of many digits, with the first six being common for all WCO member countries. The digits after the first 6 are determined by each country according to its management needs.

Therefore, the HS code for the same type of goods may differ between countries. Usually, countries add 2 or 4 more digits to create an eight or 10-digit HS code.

Check your goods' HS code accurately and quickly here.

Step 3: Identify the types of import taxes in Vietnam

Here are some types of taxes that businesses need to understand when importing goods into Vietnam:

- Import duty: To determine the import duty for your goods, you need to classify them according to Vietnam's HS code.

- Value-added tax: Most imported goods are subject to value-added tax, except for some particular types of goods.

- Special consumption tax: Some imported goods with luxury characteristics related to health, environment, etc., will be subject to special consumption tax.

- Environmental protection tax applies to goods that, when used, will cause environmental pollution, such as gasoline, coal, plant protection products, etc.

- Anti-dumping duty, anti-subsidy duty, and safeguard duty: These are taxes that Vietnam applies to imported goods considered dumped, illegally subsidized, or harmful to domestic production.

Step 4: Complete import customs clearance procedures

Customs declaration

To carry out customs clearance, businesses can fill in information on electronic customs declaration software. You need to prepare the information required for customs declaration on the electronic customs declaration software. Companies can submit the customs declaration before the goods arrive at the border gate or within 30 days from the date the goods arrive at the border gate. The customs declaration will be sent to the VNACCS system for processing.

After submitting the customs declaration, the VNACCS system will classify the batch of goods into three cases:

- Green lane means that the batch does not need to check detailed documents and goods. Businesses can clear customs and receive the goods immediately.

- Yellow lane means that the importer must submit additional paper documents for customs inspection.

- Red lane: Businesses need to submit additional documents, such as in the yellow lane case, and customs will inspect the goods. This is a particular case, only applicable when customs has doubts about the authenticity of the documents or goods.

Tax payment

Next, importers must pay various taxes and fees after customs declaration to clear customs and release goods.

In addition to the above import procedures, there are important considerations when conducting customs procedures on-spot import and export for goods, which many businesses are concerned about.

4. Other taxes and fees to be borne when importing goods

When importing goods into Vietnam, businesses have to bear basic taxes and fees, including:

- Import duty: This is the tax businesses must pay to the state when importing goods into Vietnam. The import duty rate is calculated as a percentage (%) of the taxable value of the goods.

- Value-added tax: This is the tax that businesses must pay to the state when consuming goods and services within the territory of Vietnam. The value-added tax rate is calculated as a percentage (%) of the selling price of goods and services.

- Special consumption tax: This is the tax that businesses must pay to the state when producing or importing goods with luxury characteristics related to health, environment, and social security.

- Other taxes and fees: In addition to the three basic taxes, businesses also have to bear additional fees such as fees for using technical infrastructure, quality inspection fees, quarantine fees, environmental protection taxes, anti-dumping duties, anti-subsidy duties, safeguard duties, etc.

5. In conclusion

Through this article, VICO hopes you have gained valuable information about importing goods into Vietnam. This vital activity requires businesses to understand legal regulations, customs requirements, and the transportation process. If the import procedure is not handled correctly, companies may face risks and difficulties when importing goods into Vietnam for the first time.

If your business needs professional support in importing goods into Vietnam, please get in touch with the services of VICO Logistics Vietnam. VICO is an unit specializing in providing comprehensive logistics solutions for businesses in and outside the country, applying digital supply chain methods. With over 30 years of experience in import and export, VICO Logistics Vietnam will help you save time and costs, optimize the process of importing goods, and connect Vietnam with the world through free trade agreements.

-----

VICO LOGISTICS – Indochina Logistics Expert

Premium member of Eurocham, JCtrans, VLA, VCCI,... associations

Owned offices: Hong Kong (headquarter), China (Shenzhen, Shanghai), Vietnam (Ho Chi Minh, Da Nang, Hai Phong).

Follow us for more valuable information

Book now: https://vico.com.hk/#quotation

Contact us: mkt4_hcm@vico.com.hk (For business development)