Myanmar

Myanmar Profile

1. Profile

_4ymnAEGky.png)

2. Economy & Industry

Myanmar now has a mixed economy with a private, state, and a joint private-state sector. Agriculture, light industries, and other businesses are in the private sector. Heavy industries that require huge capital investment are in the state sector. The economic reforms of the last decade sought to promote joint ventures between private Burmese and foreign firms. Therefore, foreign investments were once again encouraged with modest success.

_eub9RAp9t.png)

Industry:

Major Industries: agricultural processing; wood and wood products; copper, tin, tungsten, iron; cement, construction materials; pharmaceuticals; fertilizer; oil and natural gas; garments; jade and gems.

Services (comprising rental, transport, healthcare etc.) is the largest economic sector. The key growth driver for this sector has been tourism, which recorded significant rise with the opening up of the economy. The World Bank expects the economy’s dependency on Agriculture to continue to decrease.

_7cLGeLIqS.png)

% industry sector of Myanmar. Source from the World Bank

3. FDI attraction:

China is Myanmar's largest investor as well as the biggest trading partner, followed by Singapore, Thailand & Hong Kong. Investments are mainly focused on the sectors of hydropower, oil and gas, and mining.

Myanmar recognizes the value of investment to boost economic growth and development, and it is open to foreign investors in some sectors.

4. Export & Import:

- Major Exports: Natural gas, clothing, copper and other metals, gems & stones, wood products, and agricultural products. Top Export Partners: China, Thailand, India, Japan.

- Major Imports: fabric; petroleum products; fertilizer; plastics; machinery; transport equipment; cement, construction materials; food products, edible oil. Top Import Partners: China, Thailand, Singapore, Japan.

Sources from: www.countryreports.org

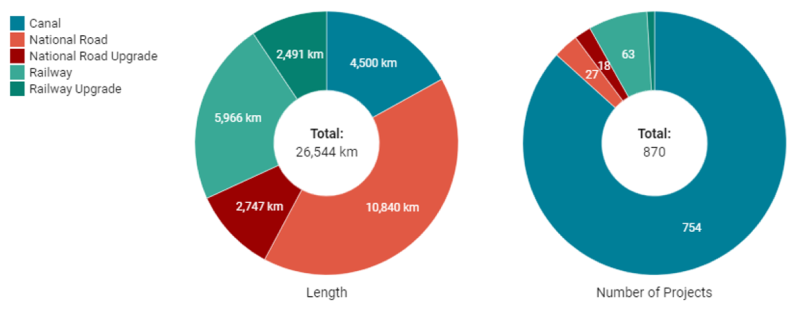

5. Infrastructure in Myanmar

Port Infrastructure

Myanmar has nine ports along its approximately 2,300 km of coastline & more than 400 ports along major rivers. Yangon’s port infrastructure handles approximately 90% of Myanmar’s total cargo.

None of Myanmar’s existing ports have access channels deep enough for large container and conventional vessels. These existing limitations have prompted the Myanmar Port Authority (MPA) to construct 6 new domestic ports along the Irrawaddy River and Chindwin, as well as establish five new international shipping terminals near Thilawa and Yangon. The construction of a deep-sea port near Yangon is also prioritized under the National Transport Master Plan.

_-sFltGXOw.png)

Air Transport

Myanmar has accessible air transportation because of high development of tourism. There are 3 large international airports in Mandalay, Naypyidaw, and Yangon as well as 30 additional domestic airports.

The government has prioritized increasing the supply and efficiency of airport infrastructure and safety regulations to meet rapidly rising passenger demand. To cope with the growing number of tourists, the government plans to upgrade domestic airports into international airports.

Road Transport

Myanmar’s roads network has expanded significantly over the last decade. Road transport dominates long-distance travel in Myanmar, but 60% of the main road still need to be upgraded. Recent years have seen significant improvements. However, approximately 40% of the population lacks basic access to all-season roads, mostly in rural areas.

Myanmar’s location makes it a nexus between the dynamic economies of South Asia, Southeast Asia, and Southwest China, and it is part of multiple economic corridors. The Asian Development Bank is currently supporting road upgrades to improve East-West linkages between Myanmar and Thailand.

Railway Transport

Myanmar has invested significantly in rail networks and currently has the longest national rail network in all of ASEAN. There is more than 5,936 km of existing rail length in Myanmar, which is significantly higher than the other lower Mekong countries.

More than half of the total rail network serves fewer than 1,000 passengers a day, which makes it difficult to justify maintaining rail services solely on a financial basis.