Table of Contents 1. Introduction 2. Understanding Vietnam’s Import Procedure 3. Common Challenges When Importing Goods to Vietnam 4. Transport Options for Importing Goods to Vietnam 5. Why VICO Logistics Is a Strong Import Partner 6. Conclusion |

Customs & Compliance: Your Expert Handbook for Import Goods to Vietnam

1. Introduction

Importing goods into Vietnam has become increasingly important as the country strengthens its position as a regional manufacturing base and consumer market. The rise of free trade agreements, the diversification of supply chains, and Vietnam’s growing demand for high quality products have encouraged companies to expand their import activities. Yet, the practical reality of moving goods through Vietnam’s customs system can feel complex, fragmented, and time sensitive.

Understanding the import procedure, choosing the right transport mode, preparing the correct documents, and managing risks are essential to maintaining cost efficiency and supply chain continuity. This guide provides a detailed look at the required steps, the common challenges of importing goods into Vietnam, and the logistics advantages that VICO offers to ensure smooth operations.

2. Understanding Vietnam’s Import Procedure

Importing goods to Vietnam follows a clear legal structure but often requires expert navigation to prevent delays or unexpected costs. Importers must work through a process that includes classification, documentation, customs clearance, tax calculation, and post clearance compliance.

2.1 Importer Requirements

Any company importing goods must possess a business registration certificate that includes the right to trade and import goods. Foreign companies often partner with a local importer of record to ensure compliance.

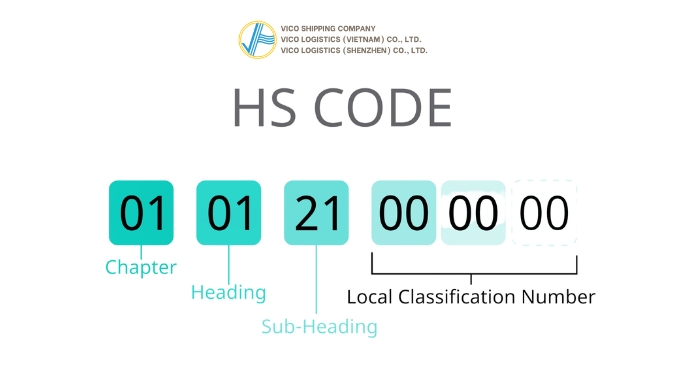

2.1.1 Step One: Determining Commodity Classification

The Harmonized System code (HS Code) determines tax obligations, licensing requirements, and inspection processes. Accurate HS coding is essential, because incorrect classification can cause customs disputes or shipment holds. We provide classification support based on updated customs guidelines and the reference list published by the Vietnam General Department of Customs.

2.1.2 Step Two: Preparing Required Documents

Document preparation is the most common cause of delays in Vietnam customs clearance.

Importers must prepare:

• Commercial invoice

• Packing list

• Bill of lading or airway bill

• Sales contract

• Certificate of origin if preferential tariffs are applied

• Import permit if the product falls under regulatory control

• Quality inspection certificates for regulated goods

Errors in declaration, mismatched values, and missing certificates are common challenges. Our document review procedures ensure alignment between all documents before submission to customs.

2.1.3 Step Three: Customs Declaration

Customs declarations are submitted electronically through the VNACCS system. Vietnam uses a risk based channel system:

• Green channel: automatic clearance

• Yellow channel: document review

• Red channel: physical inspection

Most delays occur in the yellow and red channels. VICO’s compliance team monitors customs trends and industry alerts, reducing the likelihood of inspection by ensuring accurate declarations.

2.1.4 Step Four: Tax Calculation and Payment

Taxes applied to imported goods may include import duty, value added tax, special consumption tax for certain categories, and environmental protection tax where applicable. VICO supports the importer with tax estimation during the planning phase to avoid miscalculated landed cost.

2.1.5 Step Five: Cargo Release and Delivery

Once taxes are paid and customs approves the shipment, cargo is released for delivery to warehouses or distribution centers. VICO manages last mile delivery, port handling, and container return to avoid detention fees.

3. Common Challenges When Importing Goods to Vietnam

Import procedures in Vietnam are rules based but influenced by fast changing regulations, port congestion, documentation inconsistencies, and varying interpretations by customs officers. These factors often create unpredictability for importers.

>> How to Optimize Textile Logistics with VICO's China-Vietnam LCL Consolidation Service

3.1 Challenge One: Frequent Regulatory Updates

Vietnam regularly updates its import restrictions, tax rates, and documentation standards. Non compliant shipments may be held until updated documents are provided. VICO maintains direct communication with customs offices across Vietnam, ensuring customers receive the latest regulatory guidance.

_jSlxCquhB.jpg)

3.2 Challenge Two: Inconsistent Documentation

Small errors, such as incorrect packing list quantities or value discrepancies between invoice and contract can trigger customs holds. VICO’s document audit system ensures all information is consistent and aligned.

3.3 Challenge Three: Port Congestion

Ho Chi Minh City and Hai Phong ports experience routine congestion during peak seasons. This can lead to long container dwell times and rising port fees. VICO provides arrival forecasts, priority handling, and inland transport planning to reduce waiting time.

3.4 Challenge Four: Quality and Safety Inspections

Food, electronics, medical products, and chemicals often require specialized inspections. These inspections can take several days and cause unplanned storage costs. VICO works with accredited laboratories and inspection agencies to fast track required certifications.

3.5 Challenge Five: Container Return and Detention Fees

Container import Vietnam operations often face detention charges due to delayed unpacking or long customs processes. VICO coordinates container pickup, on time stripping, and immediate return to carriers to keep costs under control.

4. Transport Options for Importing Goods into Vietnam

Choosing the correct transport mode is vital for cost performance and lead time reliability. Vietnam offers three primary import corridors: sea, air, and cross border road.

4.1 Sea Freight

Sea freight is the most common choice for import goods to Vietnam due to its cost efficiency and container capacity. Key ports include Cat Lai, Cai Mep Thi Vai, Hai Phong, and Da Nang. VICO manages full container loads, less than container loads, reefer shipments, and special equipment, providing schedule guidance and transshipment planning for shipments from Europe, China, and the United States.

4.2 Air Freight

Air freight is used for high value, urgent, or time sensitive cargo. Vietnam’s major airports such as Tan Son Nhat, Noi Bai, and Da Nang support strong international cargo flows. VICO provides air freight solutions with end to end visibility, customs clearance at the airport, and coordinated last mile delivery.

4.3 Cross-Border Road Transport

Cross border trucking is a fast growing mode, especially for cargo moving from China, Laos, Thailand, and Cambodia. Road transport offers faster transit than sea and greater flexibility for mixed loads. VICO operates bonded trucking corridors and multi country road routes, ensuring seamless border documentation and customs handling.

4.4 Combined Transport

Many companies now adopt combined modes such as sea plus truck, rail plus truck, or air plus road to optimize cost, lead time, and carbon footprint. VICO designs combined transport strategies for industries that require flexible replenishment cycles.

5. Why VICO Logistics Is a Strong Import Partner

Importing goods into Vietnam requires expertise in customs rules, local processes, multimodal transport, and regulatory risk. VICO’s strength lies in providing integrated logistics support across all import stages.

5.1 Strategic Advantages VICO Provides

- One Point of Control: VICO manages all activities including customs clearance, transport, warehousing, and delivery. Customers benefit from a unified communication channel.

- Strong Customs Expertise: Our customs specialists track regulatory changes, maintain updated HS code databases, and prepare declarations aligned with customs expectations.

- Digital Visibility: You will receive shipment tracking, customs status updates, and documentation archives through VICO’s digital platforms.

- Warehousing and Distribution: We operates bonded and non bonded facilities that support storage, consolidation, labeling, and distribution for imported goods.

- Risk Mitigation: VICO’s proactive approach to inspection readiness, documentation review, and container management significantly reduces clearance delays and unexpected costs.

6. Conclusion

Importing goods to Vietnam offers considerable opportunities, but the process requires careful management of customs requirements, documentation, transport modes, and regulatory compliance. Companies that understand these steps are better positioned to reduce delays, maintain cost stability, and strengthen their competitiveness in the Vietnamese market.

With strong customs expertise, reliable multimodal transport solutions, digital visibility, and bonded warehousing capabilities, VICO Logistics supports customers at every critical stage of the import journey. As Vietnam continues to expand its role in global supply chains, working with a capable logistics partner ensures that import operations remain efficient, compliant, and ready for future growth.

Learn more the next article at The Most Common Types of Trucks in Vietnam’s Transport and Key Considerations for Safe Shipping

>> Guide to Exporting and Transporting PVC Resin from Vietnam to Cambodia - VICO Logistics

-------------------------------

VICO Logistics – Your Indochina Expert

Premium member of Eurocham, JCtrans, VICOFA, VITAS... associations

Owned offices:

- Hong Kong (Causeway Bay),

- China (Luohu-Shenzhen, Hongkou-Shanghai),

- Vietnam (Bay Hien - Ho Chi Minh, Hai Chau- Da Nang, Gia Vien- Hai Phong).

Follow us for more valuable information

Book now: https://vico.com.hk/#quotation

| Contact us:

|